This op-ed by State Policy Network’s Michael Lucci was first published at National Review.

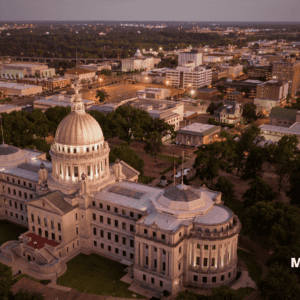

In a rare feat of bipartisan tax reform, Mississippi lawmakers have begun addressing the pressing needs of the post-pandemic economy. On March 27, Governor Tate Reeves signed H.B. 1733 into law after it cleared both legislative chambers unanimously. Sponsored by Representative Trey Lamar and Senator Chris Johnson, the new law creates full expensing for capital investments in research, experimentation, machinery, and equipment in the Magnolia State.

Other state legislatures and Congress should take notes. Full expensing addresses two problems facing the post-pandemic American economy: the need to re-shore critical supply chains and the need to protect business capital investments from the ruinous effects of inflation. Regardless of political affiliation, people concerned about securing America’s vital supply chains and leading in the global economy should support the implementation of full expensing in both state and federal law. The members of Mississippi’s house and senate certainly understood this, voting 111–0 and 52–0 in favor of the law, respectively.

Full expensing enables businesses to immediately deduct the entire cost of capital expenditures from taxable income, rather than spreading out those deductions over years or decades. This simple change unlocks surprising investment and growth. Georgetown researchers found that full expensing boosts business capital expenditures by 21.5 percent and wages by 5 percent. A Penn Wharton study found it boosts manufacturing employment by nearly 10 percent. And the Tax Foundation estimated that full expensing would boost GDP by 2.3 percent and grow America’s capital stock by 6 percent. In other words, this is precisely the sort of tax reform that America’s stagnating economy needs.

Read the full piece at National Review here.